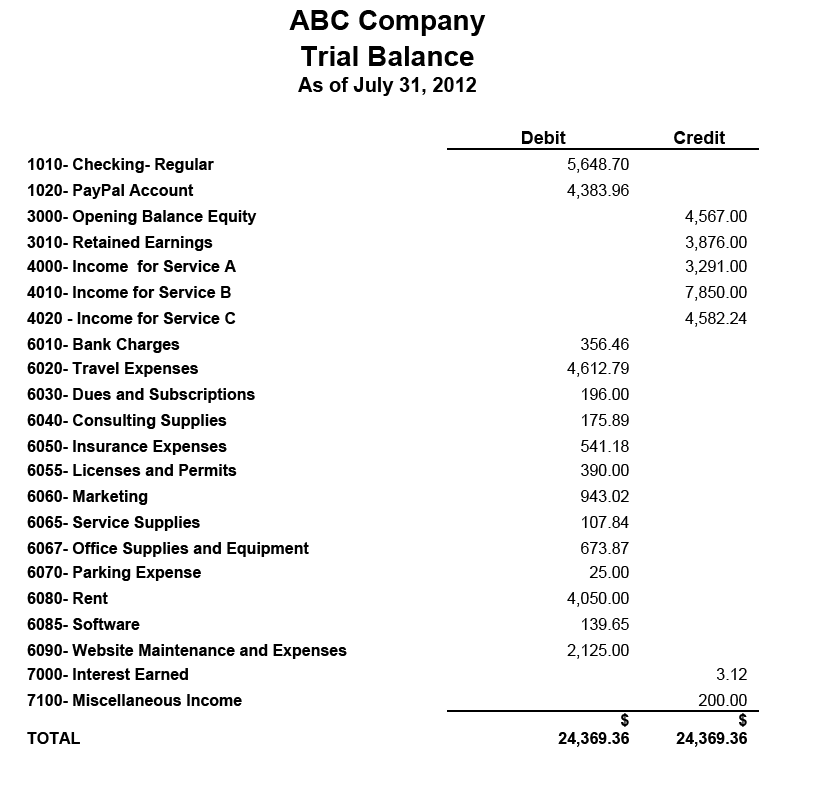

Trial Balance

A trial balance ensures that the accounting records contain correct numbers and math.

The trial balance gives a snapshot of the account balances at a certain point in time but does not include as many details as a general ledger.

The trial balance lists all accounts and balances; the debit column should agree with the balance in the credit column. If they do not agree, review the transactions and correct the error. This step is important in the manual system of accounting because math errors are likely to occur.

The trial balance shows mathematically correct ending balances in the order the items appear in the statements, which helps compile financial statements.

However, if a certain transaction is misclassified, the trial balance will not identify the error because it does not show difference between the columns.

For example, a $100 software expense misclassified as marketing would not cause a difference in the credit and debit columns. However, financial professionals who have knowledge of specific business transactions can review the numbers to identify and correct errors.