Cost of Goods Sold

Cost of goods sold, also known as COGS, is typical of retail and manufacturing companies. After making a sale, a company deducts costs directly related to the sale from the revenue, such as purchased inventory or costs associated with manufacturing the product (materials, labor, rental, utilities, etc.).

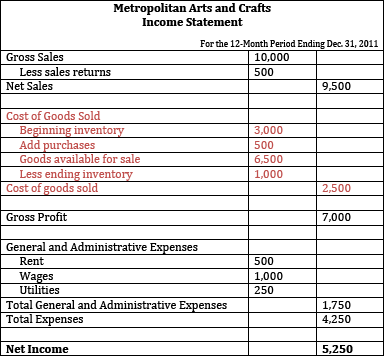

As shown in red in this income statement, the cost of goods sold appears after the sales section.