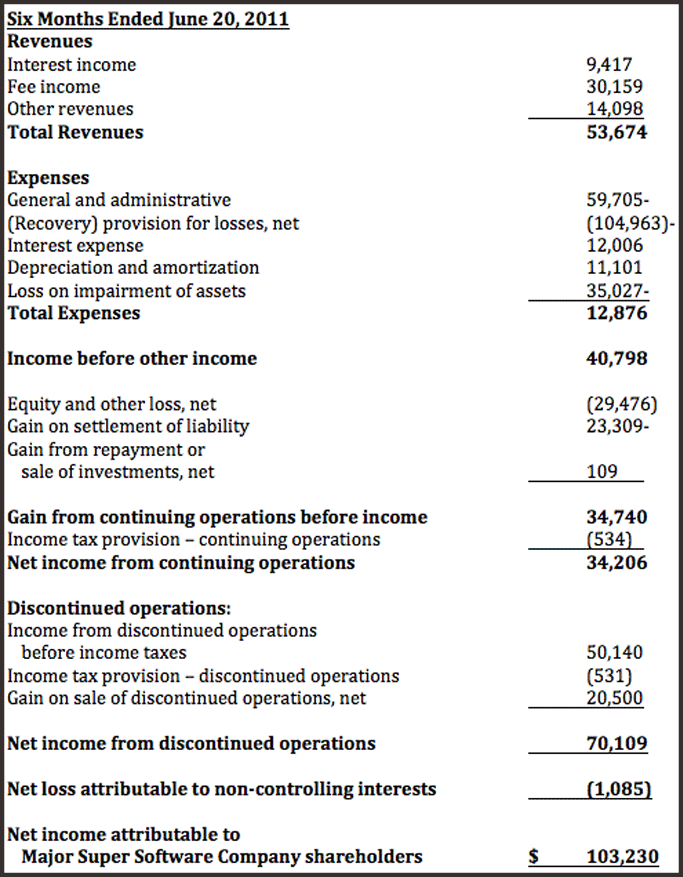

Separate Items on the Income Statements

To facilitate review and analysis, the income statement separates nonrecurring event transactions from operating transactions. If the income statement included these items as regular daily activities, it could create a false sense of the company's financial situation.

This example income statement reflects a gain of $20,500 from the sale of discontinued operations. If the $20,500 gain were part of operations, operations would increase by this amount, creating the false sense that this type of gain is part of daily activities.

Like other items in the income statement, these numbers may or may not reflect cash payments, depending on the basis used to compile the financial statements. If a company uses cash basis, these special items reflect money received or paid out. However, if a company uses the accrual basis, these items could reflect invoices sent out or bills received, not necessarily monetary transactions.