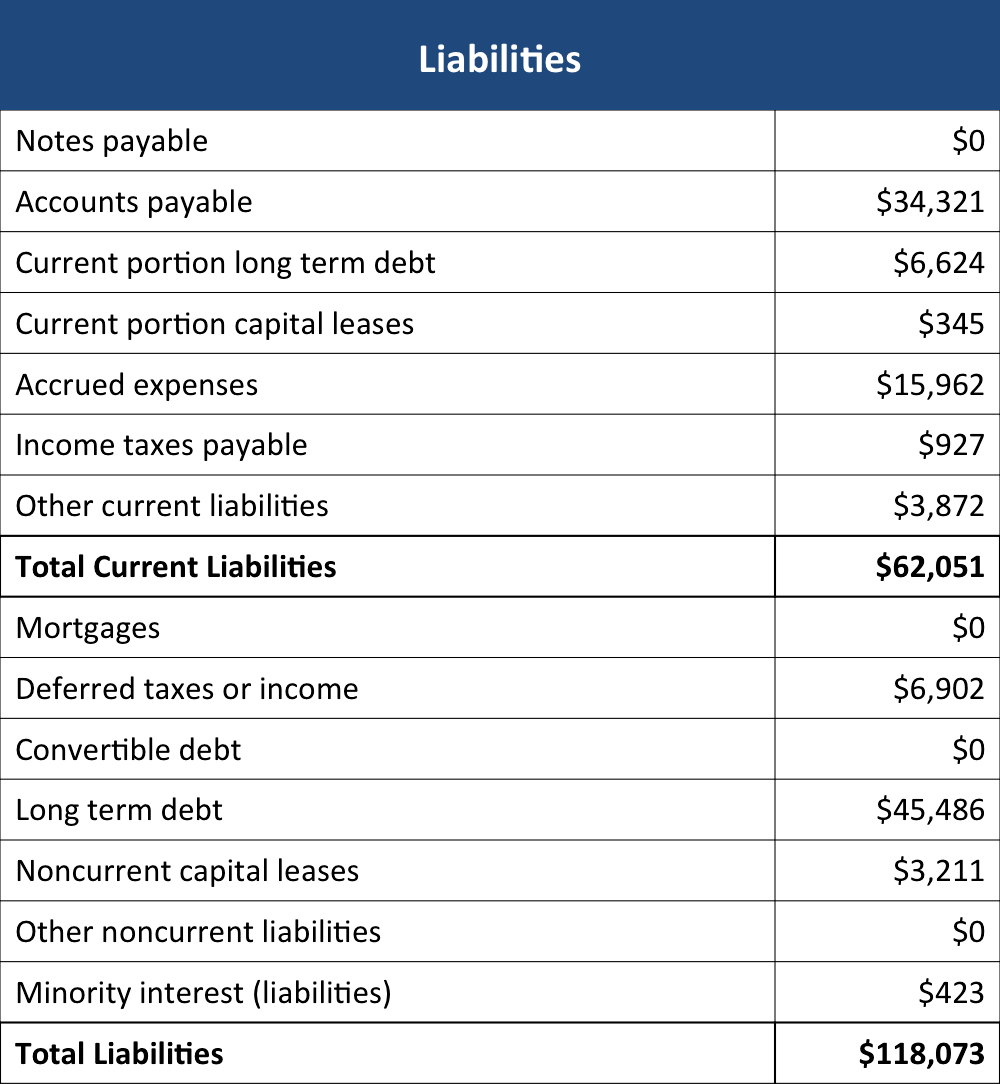

Accounts Payable

Accounts payable, the most popular current liability, reflects bills entered in the system but not yet paid.

Accrued liabilities, often listed as part of current liabilities, represent amounts the company has not yet input into the accounts payable list. Balance sheets can estimate these liabilities. For example, a business may pay utilities once every three months, but it creates financial statements (such as balance sheets) every month, forcing it to recognize liabilities not in the accounts payable system each month. Another example is income taxes. Companies know they will owe taxes at the end of the year but do not know exactly how much. A balance sheet estimates those taxes in the liabilities section.